Makaleler

42

Tümü (42)

SCI-E, SSCI, AHCI (19)

SCI-E, SSCI, AHCI, ESCI (25)

ESCI (6)

Scopus (25)

TRDizin (8)

Diğer Yayınlar (8)

2. Return Transmission among Fossil Energy Commodities, Clean Energy Stocks, Green Bonds, and Energy Cryptocurrency

JOURNAL OF MEHMET AKIF ERSOY UNIVERSITY ECONOMICS AND ADMINISTRATIVE SCIENCES FACULTY

, cilt.12, sa.3, ss.882-899, 2025 (ESCI, TRDizin)

5. The Effects of Global Volatility Indices on Green and Fossil Energy Markets

FINANCE A UVER-CZECH JOURNAL OF ECONOMICS AND FINANCE

, cilt.75, sa.3, ss.277-302, 2025 (SSCI, Scopus)

9. Environmental, social, and governance (ESG) investing and commodities: dynamic connectedness and risk management strategies

SUSTAINABILITY ACCOUNTING MANAGEMENT AND POLICY JOURNAL

, cilt.14, sa.5, ss.1052-1074, 2023 (SSCI, Scopus)

17. The impact of temperature anomalies on commodity futures

ENERGY SOURCES PART B-ECONOMICS PLANNING AND POLICY

, cilt.16, sa.4, ss.357-370, 2021 (SCI-Expanded, Scopus)

18. DYNAMIC CONNECTEDNESS BETWEEN ISLAMIC MENA STOCK MARKETS AND GLOBAL FACTORS

INTERNATIONAL JOURNAL OF ECONOMICS MANAGEMENT AND ACCOUNTING

, cilt.29, sa.1, ss.93-127, 2021 (ESCI)

26. Detecting Multiple Bubbles in International Stock Markets with Recursive Flexible Windows

Dokuz Eylül Üniversitesi İşletme Fakültesi Dergisi

, cilt.19, sa.2, ss.193-200, 2018 (TRDizin)

27. Türkiye Konut Piyasasında Balon Var Mı? İstatistiki Bölge Birimleri Üzerine Bir Analiz

Finans Politik ve Ekonomik Yorumlar Dergisi

, cilt.55, sa.646, ss.85-113, 2018 (TRDizin)

29. Detecting Bubbles in the US Stock Market: A New Evidence from the Bootstrap Cointegration Test in ESTAR Error Correction Model

The Empirical Economics Letters

, cilt.16, sa.9, ss.941-950, 2017 (Hakemli Dergi)

30. Borsa İstanbul’da Rasyonel Balon Varlığı: Sektör Endeksleri Üzerine Bir Analiz

Finans Politik ve Ekonomik Yorumlar Dergisi

, cilt.54, sa.629, ss.63-76, 2017 (TRDizin)

31. Who Drives Whom? Investigating the Relationship Between the Major Stock Markets

Financial Studies

, cilt.20, sa.2, ss.6-24, 2016 (Hakemli Dergi)

33. The interactions between oil prices and Borsa Istanbul sector indices

International Journal of Economic Policy in Emerging Economies

, cilt.7, sa.1, ss.55-65, 2014 (Scopus)

39. Volatility Shifts and Persistence in Variance Evidence from the Sector Indices of Istanbul Stock Exchange

International Journal of Economic Sciences and Applied Research

, cilt.3, sa.2, ss.119-140, 2011 (Hakemli Dergi)

42. An Examination of Risk and Return Trade off in Manufacturing Industry: An Asset Pricing Approach

Middle Eastern Finance and Economics

, cilt.4, sa.1, ss.5-27, 2009 (Hakemli Dergi)

Hakemli Bilimsel Toplantılarda Yayımlanmış Bildiriler

27

4. Time and Frequency Connectedness of Cryptocurrency, Stock, Currency, Energy, and Precious Metals Markets

CRYPTOCURRENCY RESEARCH CONFERENCE 2021, Southampton, Birleşik Krallık, 16 Eylül 2021, (Özet Bildiri)

5. Environmental, social, and governance (ESG) investing and commodities: dynamic connectedness and risk management strategies

ICEEE'2021 International Conference on Economics, Energy and Environment, Türkiye, 1 - 03 Temmuz 2021, (Özet Bildiri)

6. The Impact Of Temperature Anomalies On Energy And Agricultural Commodity Futures

International Conference on Economics, Energy and Environment, Nevşehir, Türkiye, 23 - 25 Nisan 2020, (Özet Bildiri)

7. Volatility Spillover Effects in Borsa Istanbul: Dynamic Connectedness Approach Based on VAR

VI. International Conference on Applied Economics and Finance, Balıkesir, Türkiye, 16 - 17 Kasım 2019, ss.58, (Özet Bildiri)

10. Information Efficiency and the Closed-end Fund Discount Puzzle

The International Finance and Banking Society (IFABS) Angers 2019 Conference, Angers, Fransa, 27 - 29 Haziran 2019, (Özet Bildiri)

13. Does Sentiment Affect Capital Structure Decisions?

Istanbul Finance Congress (IFC-2018), İstanbul, Türkiye, 1 - 02 Kasım 2018, (Özet Bildiri)

14. Foreign Exchange Rate Movements of Fragile Five Economies: Do They Follow the U.S. Dollar Index?

22. Finans Sempozyumu, Türkiye, 10 - 13 Ekim 2018, ss.531-542, (Tam Metin Bildiri)

17. Türkiye Konut Sektöründe Rasyonel Balon Araştırması

21. Finans Sempozyumu, Balıkesir, Türkiye, 18 - 21 Ekim 2017, ss.789-808, (Tam Metin Bildiri)

18. The Performance of Deposit and Islamic Banks in Turkey

EconAnadolu 2013: Anadolu International Conference on Economics III, Eskişehir, Türkiye, 19 - 21 Haziran 2013, ss.269, (Özet Bildiri)

19. Sermaye Yapısı Kararları ve Temettü Politikalarının Hisse Senedi Getirilerine Etkisi: İmalat Sanayi Üzerine Uygulama

15. Ulusal Finans Sempozyumu, Türkiye, 12 - 15 Ekim 2011, ss.92-101, (Tam Metin Bildiri)

20. Yapısal Kırılmalar Altında Oynaklık Öngörümlemesi: İstanbul Menkul Kıymetler Borsası Finansal Sektör Endeksleri Örneği

16. FİNANS SEMPOZYUMU, Türkiye, 10 - 13 Ekim 2012, (Tam Metin Bildiri)

21. Impact of Oil Price and Exchange Rate on Economic Output Level: Evidence from Turkey

1st International Symposium on Accounting and Finance, Gaziantep, Türkiye, 31 Mayıs - 02 Haziran 2012, (Tam Metin Bildiri)

22. The Linkages Between the U.S. Crude Oil Prices and the Sub-Sector Indices of Istanbul Stock Exchange: Evidence from the VARFIMA Model

1.International Symposium on Accounting and Finance, Gaziantep, Türkiye, 31 Mayıs - 02 Haziran 2012, (Özet Bildiri)

23. The Impact of Oil Price Shocks on the Volatility of Turkish Stock Market

EuroConference 2011:Crises and Recovery in EmergingMarkets, İzmir, Türkiye, 27 - 30 Haziran 2011, ss.157, (Özet Bildiri)

24. İmalat ve Kimya-Petrol-Plastik Sektörlerinin Endeksleri Arasındaki İlişki

14. Ulusal Finans Sempozyumu, Türkiye, 3 - 06 Kasım 2010, ss.337-346, (Tam Metin Bildiri)

25. Volatility Shifts and Persistence in Variance: Evidence from the Sector Indices of Istanbul Stock Exchange

The Society for the Study of Emerging Markets Euro Conference 2010, Muğla, Türkiye, 16 - 18 Temmuz 2010, (Tam Metin Bildiri)

26. The Turkish Stock Market Integration with Oil Prices: Co-integration analysis with two unknown regime shifts

9th International Conference of the Middle East Economic Association, İstanbul, Türkiye, 24 - 26 Haziran 2010, ss.27-28, (Özet Bildiri)

27. Standartlara Eleştirel Bakış: Standart mı? Kaos mu?

13. Türkiye Muhasebe Standartları Sempozyumu, Kıbrıs (Kktc), 18 - 22 Kasım 2009, ss.50-60, (Tam Metin Bildiri)

Kitaplar

3

3. I-İ Harfleriyle Başlayan Finansal Kavramlar

Finansın Temel Kavramları: Güncel Örnekler ve Yaklaşımlar ile, Aysel Gündoğdu, Editör, Gazi Kitabevi, Ankara, ss.243-257, 2018

Diğer Yayınlar

2

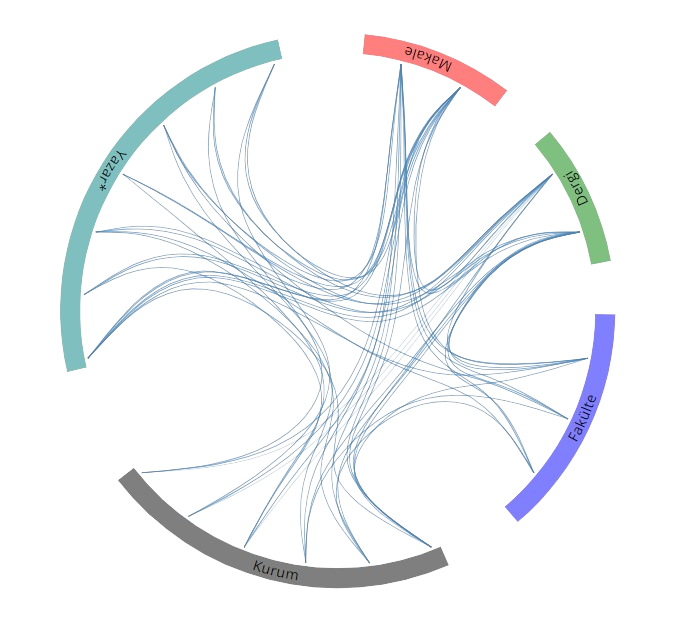

Yayın Ağı

Yayın Ağı