Makaleler

24

Tümü (24)

SCI-E, SSCI, AHCI, ESCI (1)

ESCI (1)

TRDizin (18)

Diğer Yayınlar (5)

5. Kripto Varlıklarda Fırsat ve Tehditler

İmbat Dokuz Eylül

, sa.21, ss.62-69, 2024 (Hakemsiz Dergi)

6. Vergi Okuryazarlık Düzeyinin Belirlenmesinde Bir Analiz ve Vergi Eğitiminde Metaverse

Yönetim ve Ekonomi: Celal Bayar Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi

, cilt.30, sa.Cumhuriyetin 100. Yılı Özel Sayısı, ss.83-105, 2023 (TRDizin)

14. Vergi Yükü ve Vergi Sorumluluğunun Mükellefiyet Seçiminde Etkisi

The Journal of Academic Social Science (Asosjournal)

, sa.38, ss.171-184, 2016 (Hakemli Dergi)

16. Vergi Bilincinin Oluşumunda Bilişim TeknolojilerininRolü: İzmir İli İçin Bir Uygulama

SOSYOEKONOMI

, cilt.22, sa.22, ss.34-54, 2014 (ESCI)

17. Türkiye de Yerel Yönetimlerde Mali Özerklik ve Vergilendirme Yetkisi

Sayıştay Dergisi

, cilt.84, ss.25-45, 2012 (TRDizin)

18. İş Ortaklığı ve Adi Ortaklık Şeklinin Vergilendirme Boyutu ve Muhasebe Kayıt Düzeninde İncelenmesi

Vergi Dünyası

, sa.348, ss.142-148, 2010 (TRDizin)

19. Ticari Defterlerin İspat Kuvveti ve Kanıt Olma Niteliği

Dayanışma Dergisi

, cilt.98, ss.70-74, 2007 (Hakemsiz Dergi)

20. İdareler arası Mali İlişkilerin Reform Kapsamında Değerlendirlmesi

Dayanışma Dergisi

, sa.96, ss.32-41, 2007 (Hakemli Dergi)

21. Malezya Vergi Sisteminin İrdelenmesi

Vergi Dünyası

, sa.301, ss.33-40, 2006 (TRDizin)

22. Emtia Değerlemesinde Özellik Arz Eden Hususlar

Vergi Dünyası

, sa.303, ss.28-33, 2006 (TRDizin)

23. Kanada Vergi Sisteminin İrdelenmesi

Vergi Dünyası

, sa.299, ss.37-43, 2006 (TRDizin)

24. Sahte ve Muhteviyatı İtibari İle Yanıltıcı Belge Kullananların Vergi Yasaları Karşısındaki Durumu

Vergi Dünyası Dergisi

, sa.299, ss.184-187, 2003 (TRDizin)

Hakemli Bilimsel Toplantılarda Yayımlanmış Bildiriler

12

7. City Tax In The Light Of Taxatıon Method And Practıcalıty

1.Internatıoanal Conference On Economıcs Business Management And Socıal Scıences, Sarajevo, Bosna-Hersek, 5 - 09 Eylül 2016, ss.14, (Özet Bildiri)

10. 21 Yüzyılda Home Ofis Çalışma ve Kadın

5.Internatıonal Conference on Gender/women’s Studies, Magosa, Kıbrıs (Kktc), 25 - 27 Mart 2015, ss.82, (Özet Bildiri)

12. Evaluation of Tax Payer Orientated Approach in Tax Collection

International Conference on Social Sciences (ICSS), İzmir, Türkiye, 21 - 24 Ağustos 2008, ss.133-148, (Tam Metin Bildiri)

Kitaplar

9

1. Vergi Muhasebesi Cezalı Tarhiyata Konu İşlemler

Nobel, Ankara, 2021

2. VERGİLENDİRMEDE YASAL GÜVENCE VE İLKELER: YARGIÇ DEĞERLENDİRMELERİ

EKONOMİ POLİTİKA VE UYGULAMALARININ AMPİRİK TAHLİLİ: İktisat, Finans, Maliye, Karabulut Şahin, Editör, Gazi Kitabevi, Ankara, ss.423-447, 2021

3. Kamu Maliyesi

NOBEL, Ankara, 2019

5. Entelektüel Sermaye Olarak Marka (Vergileme ve Pazarlama Boyutuyla)

BETA, İstanbul, 2018

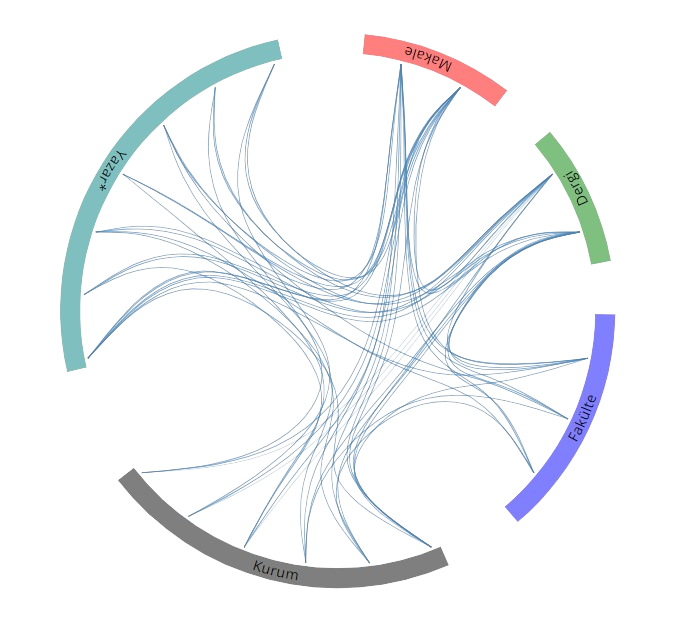

Yayın Ağı

Yayın Ağı